Unlocking Efficiency: A Guide to using Meteora DLMM

hey anon!

Today, we get into AMMs, Liquidity Pools, Meteora DLMM, trading strategies, and a lot more. For your convenience, we’ve divided the article into two sections -

Part 1 consists of an introduction to AMM, Liquidity Pools, and challenges in an AMM.

Part 2 dives deep into Meteora DLMM, how it’s different from other Market Makers, basic & advanced strategies for LPs, why and how projects can use Meteora and we also make our first trade at the end!

If you’re already familiar with the basics and challenges of AMMs & Liquidity Pools. Click here to skip to Part Two.

Happy reading!

Part 1

AMM and Liquidity Pools 101

Imagine you’re travelling from your home country BonkLand to country RugPull. Both countries use different currencies namely $BONK & $RUG respectively. Before travelling you decide you want to convert the 500 units of BONK which will convert to 100 units of RUG to arrange for your travel. You head to a currency exchange and ask for the same. The banker informs you that they're unable to fulfill your request immediately. You're left waiting anxiously as they explain that they lack RUG in their reserves and must wait for someone seeking to exchange RUG for BONK to arrive. Now after waiting for an eternity, a gentleman appears, seeking to swap 50 units of RUG for BONK. Despite this partial success, you find yourself still holding onto 250 units of BONK, a frustrating reminder of the incomplete transaction.

Of course, this is dramatized but this mirrors the workings of traditional order books in Centralised Exchanges and some DEXes, where participants must wait for counterparties with matching orders, often resulting in delays and inefficiencies.

Initially, DEXs deployed market-making order books similar to Traditional Finance (TradFi). However, a key challenge for early DEXs was liquidity. For less well-traded pairs or pairs launched recently, low liquidity resulted in slow execution, stale order books, and significant differences between the selling and buying price (bid-offer spread).

How did we solve this?

✨ Automatic Market Makers (AMM) ✨

The above problems have by and large been solved by the introduction of ‘Automated Market Makers’ (AMM). AMM-based DEXs replace order books with a ‘liquidity pool’.

Let’s understand what AMMs and Liquidity Pools are using a simple analogy.

AMMs 🤝 Vending Machine

A good analogy to understand automated market makers (AMMs) & Liquidity Pools is to think of them as vending machines for exchanging different types of snacks. Just like a vending machine, an AMM allows you to swap one type of snack for another, such as trading a bag of chips for a chocolate bar.

Here, the vending machine automatically adjusts the exchange rate based on the availability of snacks inside it. If a particular snack is running low, its price goes up, and if it's being restocked frequently, its price goes down.

Similarly, an AMM uses algorithms to set token prices based on the ratio of assets in the pool. When a user wants to trade, they swap one token for another directly through the AMM, with prices determined by the pool's algorithm.

This analogy helps to illustrate how AMMs facilitate the exchange of tokens using liquidity pools and how prices are dynamically determined based on the available assets.

Liquidity Pools

With reference to the above analogy, contributing towards the supplies of the vending machine would get you an additional fee on top of the amount the consumers pay while using the machine. In this case, the snack vendors become the liquidity providers to the vending machine i.e., the liquidity pool.

Liquidity pools are collections of funds locked in an exchange to facilitate the trading of tokens without third parties. They allow you to provide liquidity and earn fees from the trades that occur in the pool. To provide liquidity you need two or more tokens that will be exchanged for one another in the pool.

AMM protocols typically support trading between different token pairs, creating multiple liquidity pools based on these pairings. For example, a liquidity pool might offer trading between SOL and USDC.

In a nutshell, AMM’s help in

Increasing Liquidity: Liquidity pools bring together assets for trading, lending, and other financial activities, providing much-needed liquidity to the DeFi ecosystem. This increased liquidity ensures that tokens are always available for trading, even for less frequently traded assets.

Accessibility and Democratization: Liquidity pools democratize access to financial markets. By removing the need for intermediaries, AMMs enable anyone with an internet connection and digital assets can become a liquidity provider and earn a share of trading fees and other rewards.

Incentivization: Liquidity providers are rewarded for their participation through trading fees and other rewards.

This fee, in part or in full, is transferred to liquidity providers.

LPs are rewarded with tokens providing governance rights (e.g. SRM, RAY) also referred to as yield farming.

Token holders can vote to add features like fee shares essentially moving towards a model of community governance or a DAO structure.

Providing liquidity is also a smart way to increase activity on DEXs / Chains to attract future airdrops.

This was working great until…

A few challenges cropped up

Slippage: When a trade is executed on an AMM, the trade is automatically calculated via a smart contract. Slippage occurs when the price at which a trade is executed differs from the expected price. This can happen due to the constant price adjustments in the liquidity pool as a result of trades, especially for larger trades, leading to price impact and slippage.

Capital Inefficiency: AMM’s fundamental setup ensures an equal distribution of liquidity across every point of the curve. Consequently, if price movements occur within a specific segment of the curve, only a portion of the tokens in the pool are likely to be traded. As a result, tokens that could have been employed to offset significant price fluctuations might remain unused, leading to capital inefficiency.

Impermanent Loss: It happens when the price of your deposited assets changes from the time you deposited them. Imagine a trader who adds liquidity to a pool consisting of equal amounts of SOL and USDC tokens. Initially, they provide liquidity to a pool with a 50:50 ratio of SOL to USDC. However, as time passes, the price of SOL rises relative to USDC. Due to arbitrage activities and the pool's algorithms, the proportion of assets in the pool changes.

Now, let's say the trader decides to remove liquidity from the pool. If the price of SOL has increased, they would receive more USDC and less SOL compared to their initial deposit. This difference in value between their initial deposit and the value at the time of withdrawal is known as Impermanent Loss.

This gap is “impermanent” because it is possible to close the gap if the token price returns to the former price. However, if the investor withdraws their funds from the liquidity pool before the price returns to the former price, the loss becomes realized in full.

Part 2

Presenting Meteora DLMM

Meteora Platform

Meteora is a DeFi protocol on Solana building next-generation liquidity infrastructure to optimize yields, capital efficiency, and risk management for both individual users and protocols. Meteora has over $3.4 Billion in swap volume and over $63 million in Total Volume Locked as of January 24’. Meteora has several key products such as:

Meteora Pools - these pools efficiently combine liquidity from multiple assets into a single pool, enabling LPs to diversify their holdings and optimize capital utilization.

Dynamic Vaults - enable automated yield optimization and risk management for liquidity providers. Users can deposit and withdraw assets from the vaults anytime.

Farms - The farming program allows Liquidity Providers (LPs) who deposit in Meteora pools to stake LP tokens and earn rewards.

DLMM - We’re going to talk about this in detail!

Let’s dive deep in DLMM Pools (no pun intended)

Overview

DLMM is a new form of concentrated liquidity AMM on Solana, developed to enhance the efficiency and profitability of token trading, particularly for liquidity providers who play a crucial role in facilitating transactions. Remodeling liquidity management and optimization opens doors for wider participation by the DeFi community.

Let's delve into some of its distinctive features:

Concentrated Liquidity - Unlike conventional AMMs that distribute liquidity across various price ranges, DLMM helps liquidity providers to concentrate their funds within specific price intervals. This targeted approach enhances capital efficiency, enabling smoother execution of larger trades with reduced price slippage. Traders benefit from more stable and predictable prices, while liquidity providers stand to gain a chance to earn higher fees & rewards.

Dynamic Pricing - DLMM incorporates a dynamic fee mechanism to adapt to market volatility. This feature dynamically adjusts trading fees in real-time according to prevailing market conditions. While traders may experience slightly increased trading costs during volatile periods, liquidity providers can capitalize on higher fee earnings during active market phases, compensating for heightened risks such as impermanent loss. LPs can claim these fees whenever they are available.

Read more about how the variable fees are calculated here.Bins Architecture - DLMM utilizes a unique 'bins' system, comprising segmented pools of liquidity at fixed price points. Each bin hosts liquidity for a specific price level, collectively forming a comprehensive Liquidity Pool. This framework mitigates price impact during trades, offering traders improved price execution. For liquidity providers, the bins system allows precise allocation of funds, optimizing earning potential in response to market volatility.

The active bin represents the current 'market price' of assets in DLMM. It contains both tokens and accumulates trading fees. Thus, maintaining liquidity within the active bin is essential to accrue trading fees. Once the price shifts to a different bin, the previous active bin becomes inactive, ceasing to generate fees.

How is DLMM different from AMM?

While dynamic liquidity management mechanisms (DLMM) have addressed slippage and capital inefficiency to a significant degree, impermanent loss is still a possibility. Nevertheless, employing appropriate strategies enables traders to effectively mitigate this risk within DLMM frameworks.

DLMM > AMM, but how?

As we know by now, DLMM is a new form of concentrated liquidity AMM on Solana, developed to make it easier and more sustainable for users and project teams to provide broader, deeper liquidity.

Meteora's Dynamic Liquidity Market Maker (DLMM), provides liquidity providers with access to

Dynamic Fees: Liquidity Providers earn dynamic swap fees during high market volatility to compensate for the risk of impermanent loss. This feature allows LPs to earn more during periods of high volatility, enhancing their overall profitability.

High Capital Efficiency: DLMM enables liquidity providers (LPs) to focus their liquidity more precisely, not just within a specific price range, but also by creating liquidity shapes that align better with price movements. This optimized approach allows LPs to utilize their capital more efficiently.

Zero Slippage: In regular AMMs, the price of assets changes with each trade because the pool's makeup shifts. This can lead to "slippage," where traders don't get the exact price they expected. However, with DLMM's bin setup, trades can happen without slippage. Swaps that happen within the same price bin do not suffer from slippage, providing a more efficient and predictable trading experience for users.

Flexible Liquidity: LPs can build flexible liquidity distributions according to their strategies. This feature allows LPs to tailor their liquidity provision to specific market conditions and trading pairs, providing a more customizable and adaptable approach to liquidity provision. These features collectively empower liquidity providers with a more efficient, profitable, and customizable liquidity-providing experience.

Strategies on DLMM

Meteora has introduced a variety of liquidity strategies that can be deployed using the platform’s DLMM. These strategies are split between basic and advanced, catering to users with varying levels of expertise.

Let's dive into some juicy strategies for maximizing your returns and minimizing those pesky risks in the world of liquidity provision. We've got a buffet of options here, so grab a seat, and let's feast on some knowledge!

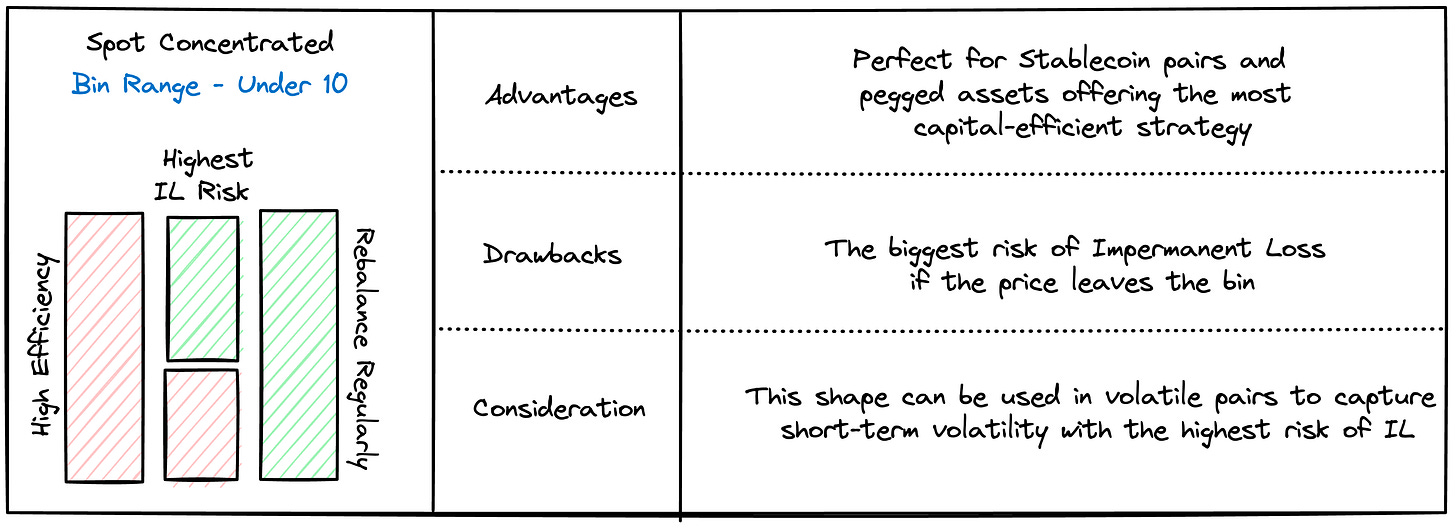

Spot: Concentrated

The Concentrated shape is tailored for those seeking to maximize rewards while maintaining a cautious approach.

Suitable for stablecoin pairs, it consolidates all liquidity within one to three bins. While it has the potential to generate significant fees, it carries a heightened risk of impermanent loss (IL) and necessitates frequent rebalancing with each price movement.

Spot: Wide

Ideal for newcomers to the DLMM or those preferring fewer rebalances to perform.

The Wide shape offers a broader coverage spanning approximately 20 to 40 bins. This strategy provides a buffer against asset price volatility while minimizing risk exposure. It ensures a steady stream of fees, even during market fluctuations, making it suitable for less frequent rebalancing, typically every few days.

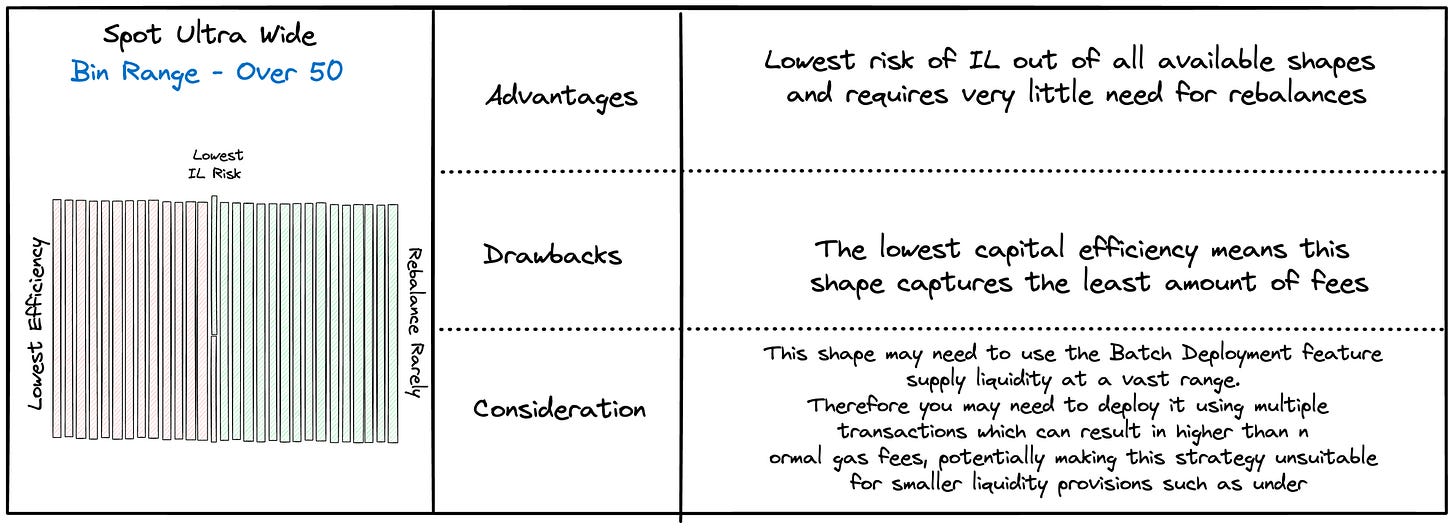

Spot: Ultra Wide

The Ultra Wide shape caters to individuals seeking fewer rebalances to perform.

By expanding liquidity deployment across a wider range of bins, ensures price stability under varying market conditions. However, deploying liquidity in batches through separate transactions is essential to accommodate the broader range effectively.

Curve

The Curve shape suits those comfortable with frequent adjustments but still prefer to diversify their investment, rather than focusing solely on one bin.

It strikes a balance between Concentrated and Spread shapes, concentrating liquidity around a single price point while spreading some across nearby bins. This allows users to capitalize on short-term price changes efficiently, ideal for stable pairs with soft pegs or volatile pairs at significant price levels.

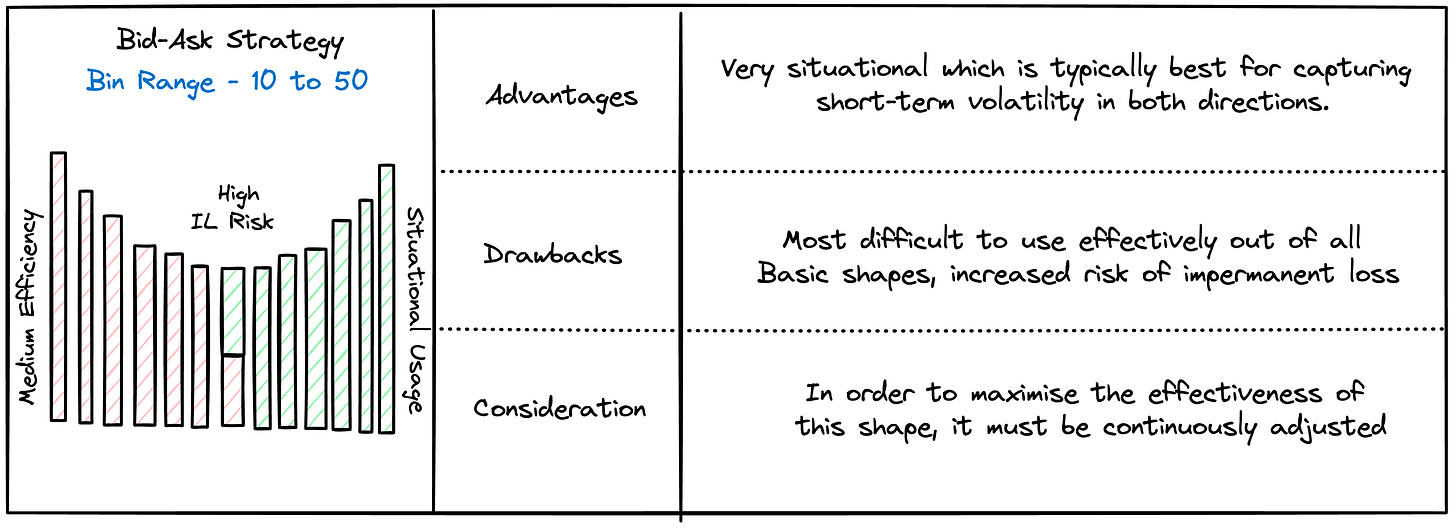

Bid-Ask

For liquidity providers ready to embrace risk, the Bid-Ask shape offers a potent tool.

It's the most intricate among basic strategies, designed to capture market fluctuations around a specific price, maximizing fees within the designated range.

Similar to the Curve strategy, Bid-Ask requires ongoing rebalancing for effectiveness. If volatility subsides or the price moves beyond the set range, adjustments are necessary to maintain optimal performance.

Let's explore some advanced strategies.

Advanced strategies simply mean combining two or more basic shapes to achieve even more granular control over liquidity.

It is also known as stacking strategies, which are like superpowers for liquidity providers. They let providers put their assets into specific price bins, which helps them use their money more effectively and focus their liquidity exactly where it's needed.

Ranged Limit Orders - Think of this as setting up specific buy or sell orders at certain price points. It's like having a plan in place for when the market hits those prices. It's useful for traders who prefer strategic adjustments to their positions.

De-peg Bets - Stablecoins aren't always as stable as they seem, right? Well, here's a way to turn that instability into profit. By combining two spot shapes, you can catch when stablecoins lose their peg to their target price.

DCA and Earn - With DLMM, you can use Dollar Cost Averaging (DCA). This means you can mix different shapes like Bid-Ask, Spot, and Curve to make a plan that fits your goals. An example for DCA and Earn is you can set a limit order to start buying when prices hit certain levels and pair it with spot liquidity to earn fees without doing much.

Dollar Cost Average In/Out (DCA) - DCA is great if you want to buy or sell tokens without worrying about price changes. You can use a single-sided shape to get the average price you want, which is helpful for big purchases or sales.

Buy or Sell Walls - Using a Spot shape, you can create a Buy or Sell Wall. This helps you earn more fees and can be like betting on a price change. Protocols can also use these walls to make sure their token stays at a certain price. They can even automatically buy back tokens if the price drops.

These strategies might seem a bit complex at first, but with a little practice, you'll soon get the hang of it. Just remember, it's all about finding what works best for you and staying flexible in the ever-changing world of trading.

If you want to learn more about advanced strategies and single-sided strategies, check out Understand Advanced Strategies & Single-Sided Strategies.

🦇 Alpha Signal

Become a Liquidity Provider on token launch days or during periods of high-volume events! Instead of relying on the same old "buy low, sell high" strategy and trying to time the market, provide liquidity during high-volume days. You can rake in a solid 1-5% in a single day alone, using Meteora DLMM's dynamic fees and flexible liquidity features! NFA, DYOR of course.

Rebalancing Your Position

As a Liquidity Provider (LP), your goal is to earn fees from trading activity within a Liquidity Pool. To do this, your liquidity must remain within a specified range.

When the price of assets in the pool changes, your liquidity may fall 'out of position', meaning it moves outside your chosen range, and you stop earning fees.

Scenario:

Let's say you provide liquidity for the SOL/USDC pair, setting your range from $100 to $105 per SOL. When SOL is at $102, you're earning fees. But if SOL rises to $108, your liquidity is out of range.

Here are some scenarios that examine the potential actions an LP could take to address being out of position.

Each decision has its risks and benefits, depending on factors like market trends, gas fees, and risk tolerance. Consider your goals as an LP and whether you prefer passive or active management when managing your liquidity position.

Why projects should use DLMM

Innovative Ways to Launch Tokens: DLMM offers fresh avenues for crypto projects to launch their tokens creatively. For instance, teams can leverage DLMM to execute a bonding curve, a token sale mechanism that incentivizes early buyers.

Flexible Token Design: DLMM allows for flexible token design, enabling project teams to design tokens in ways that align with their specific goals and strategies. This flexibility encompasses various aspects, including the ability to create custom bonding curves, concentrate liquidity in specific price ranges, and define the token's price curve. For instance, crypto projects can use a bonding curve to sell tokens and utilize the funds to support a minimum price, or they can concentrate liquidity in a narrow price range around the current market price.

Deeper Liquidity: DLMMs can provide deeper liquidity for asset pairs, even those with low trading volume, which is beneficial for the token's market stability and attractiveness to traders.

How projects can use DLMM

Before creating a DLMM pool, projects need to make decisions on many factors such as price curves, liquidity distribution, bin size, bin step, and more. These terms might sound complex, but let’s simplify:

The price curve: This describes how the token's price changes as it's withdrawn from the DLMM pool.

Liquidity distribution: It shows how many tokens are available at each price point.

Bin size: The liquidity range is divided into bins, each representing a portion of the liquidity distribution graph.

Bin Step: Every Bin has a gap between them, this gap is the price jump between each Bin, which is called the Bin Step.

Calculating the price curve, liquidity distribution, and bin size involves using formulas based on parameters like initial price, maximum selling price, total number of tokens in the pool, the speed of price increase, etc. While these formulas can be a bit technical, they ensure the DLMM pool operates smoothly.

For simplicity's sake, let's imagine a project that desires a dynamic token sale mechanism that rewards early adopters. In this scenario, the price would increase as more tokens are withdrawn from the pool. Here's how it would look:

Initially, the pool contains only token X, and there's no USDC. As users withdraw X and deposit USDC, the active bin shifts, indicating the current price of X. This process continues as more tokens are bought and sold.

In a real DLMM curve, there would be numerous bins, each representing a range of liquidity and price.

In the graph above, it can be observed there is more liquidity at higher prices compared to lower prices as liquidity increases with price.

Depending on a project's needs, they can customize the DLMM curve with different price curves and liquidity distributions. This flexibility sets DLMM apart from traditional models like Uniswap and Balancer, empowering project teams to tailor liquidity and token distribution to their specific requirements.

Note: The example provided above is quite simplistic and only scratches the surface. As previously mentioned, determining the price curve, liquidity distribution, and other related factors involves considering numerous variables and complexities.

If you're a degen like us, you might have heard about the Jupiter LFG Launchpad and the launch of the $JUP token. Did you know that Jupiter utilized the Meteora DLMM Model which played a significant role in the launch of the $JUP token.

As said by Meow - Founder of Jupiter Exchange

To learn more about Jupiter’s Token Launch - click here.

To simulate a pricing curve for your project - click here.

DLMM IT YOURSELF (DIY)

Now that you’ve learned about DLMM, let’s hear it from Ben (co-founder, Meteora) and make your first trade on Meteora!

To engage in meaningful discussions, consider joining Meteora's Discord, and be sure to follow Meteora on Twitter to stay updated on their upcoming announcements.

In this article, we've explored why and how one can use DLMM - both from a liquidity provider and a project's perspective. If you notice any inaccuracies, please share them in the comment section or DM us here, and we'll gladly make the necessary changes.

References: